Text/Call: (631) 430-4244

Get SBA Loan Approvals to Open Your First Franchise with LenPick's 5-Step System.

Streamline Your SBA Loan Process

Click any item to be taken to the section

Step 1: Start with a Lending Consultation.

We assess your background to determine your SBA loan eligibility, focusing on franchise ownership requirements.

#1

| SBA 7A Qualifications | SBA CA Qualifications |

|---|---|

| $100K - $5M | $50K - $350K |

| Credit = 625+ | Credit = No minimum |

| 20% of your total project cost saved. | 15% of your total project cost saved. |

| Must have personal income, or your spouse works, or you have savings. | |

#2

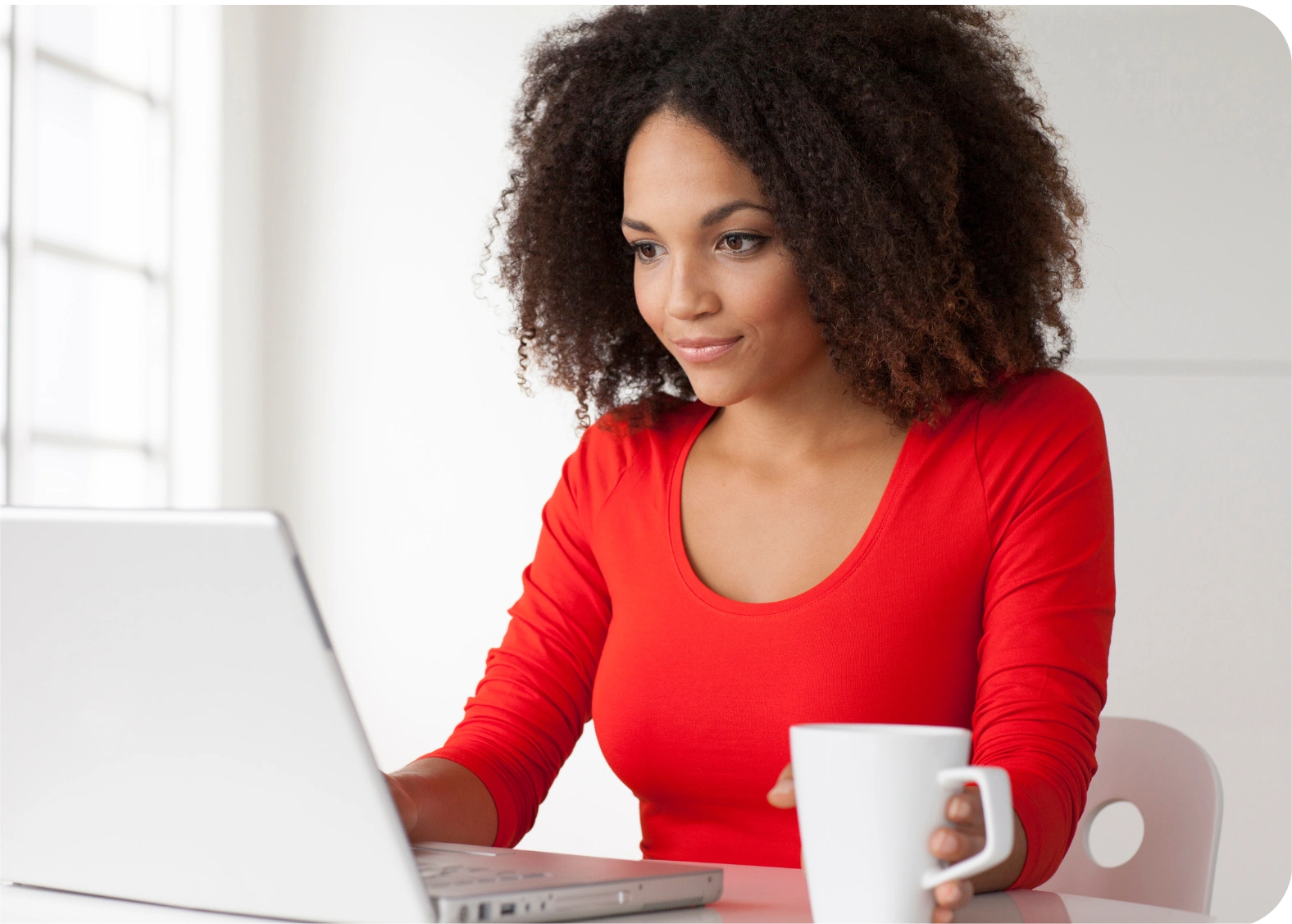

Step 2: Gather Your Financial Documents.

We review key financial documents to confirm that you have income and cash reserves necessary for SBA approval.

#3A

Step 3A: Create Your Franchise Business Plan.

We strengthen your SBA application by making sure your business plan includes:

1

Your Experience

We showcase relevant skills and experiences to support your ability to make your franchise a success.

2

Your Competition

Identifying local competitors ensures you and SBA lenders understand your franchise's market fit and differentiation.

3

Your Marketing Strategy

We outline your plans to attract customers beyond the franchise's national marketing support.

#3B

Step 3B: Create Financial projections for SBA.

Your financial projections show the financial growth of your franchise during its first 2-3 years in operation.

They include:

Explore Our Business Plan and Financial Projections Packages.

Choose from one of our three packages below to receive help with your business plan and financial projections.

Do It Yourself

Business Plan Reviewed

Financial Projections Reviewed

2 Reviews & Corrections

$199

Done With You

Business Plan Template

Financial Projections Template

2 Reviews & Corrections

$999

Done For You

Business Plan Completed

Financial Projections Completed

2 Edits

$1999

#4

Step 4: Receive Two SBA Pre-Approvals.

We have a network of 25 lenders and we match you to the ones you qualify with, based on...

Credit Score

Industry

Type of Franchise

Equity Injection

We present you SBA terms and you choose the lender you want to move forward with...

#5

Step 5: Meet Your SBA Franchise Lender.

Our streamlined SBA process means you...

Spend less time in underwriting.

Are asked fewer questions by lenders.

Can ensure you will be SBA approved.

SBA CA lenders are nonprofit institutions, which do not cover our service fees. For SBA CA loans, we charge 3% of the total loan amount upon successful funding.